The Fresh Start Offer in Compromise

The Offer in Compromise Program (OIC) is a flexible tax relief program that reduces the tax liability for people who can’t afford to pay it. In exchange, taxpayers agree to pay a discounted amount on their tax debt.

See Below for the average settlement we apply for related to what they owe. Not only can we achieve a settlement for pennies on the dollar, but it can take years off of the debt.

You are not alone. The IRS reports 937,514 taxpayers were delinquent in 2016 with an average tax debt of $59,520.

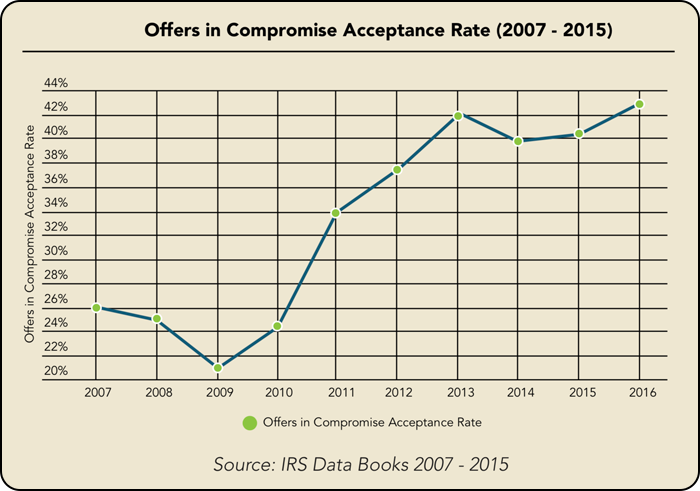

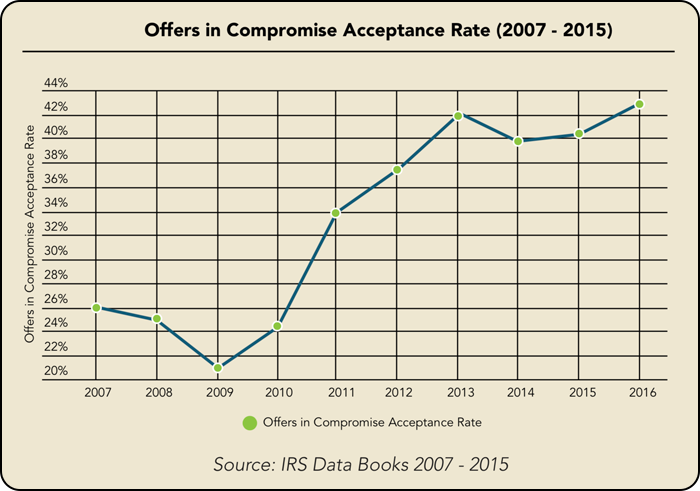

In 2016, 42.9 percent of offers in compromise — 27,000 out of 63,000 — were accepted by the IRS.

[/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]